The Firm

Fueling Business Growth with Smart Financial Strategies

Who we are

Founder’s message

We are meticulous, thorough and diligent in selecting and structuring investment opportunities, with the end goal of conceiving and nurturing long-term relationships with investors and portfolio businesses: stimulating growth and delivering exceptional results to all stakeholders.

Among our most important competitive advantages is our ability to source unique proprietary transactions that we then structure intelligently and creatively. In doing so, we mitigate risk exposure for investors, without losing sight of their aim of achieving superior returns. Thereafter, it is our team’s deep sector and market knowledge that enables us to effectively manage investments post-acquisition, drawing on a best-in-class network of partners to support our work across the region.

What does our investment process look like?

- We select investment targets that match our criteria for risk mitigation and attractive return potential

- We seed capital of 10-20% of an acquisition, with the remaining funds raised from investors on a deal-by-deal basis

- We structure transactions that will add value for both the target and the investor, yielding stable and reliable results

- Post-acquisition, we remain close to our portfolio companies, helping them to optimise performance and grow at a rate we believe they can achieve

With warm regards from the Audacia Capital team,

Emad Mansour

Founder & CEO

Board Of Directors

Management

Alyas Al Meftah

Head of Investor Relations

Alyas Al Meftah is an instrumental member of Audacia Capital and is responsible for fundraising and investor relationships in the MENA region. He brings over 18 years of experience with a successful career in investment banking and relationship management …

Philosophy

Mission

To originate, structure and offer world-class, lucrative investment opportunities to select investors in the Middle East North Africa (MENA), generating superb capital growth within a solid framework of integrity, professionalism and effectiveness.

Vision

To build Audacia Capital into an investment banking powerhouse in the MENA region.

Values

investing in our most valuable asset for the long-term benefit of the business and clients

conforming to the highest standards of integrity in every relationship and interaction

maintaining client confidentiality as a key value of our business

applying the highest standards of professionalism in all business dealings

thinking creatively, identifying untapped opportunities and deploying sophisticated solutions to complex financial challenges

respecting the values and objectives of our clients and partners, respecting regulations and respecting the environment

Our people

Everything that we do is underpinned by experienced investment professionals of high calibre. They are the bedrock of our organisation and ensure that Audacia Capital is a house of excellence, delivering on its vision, mission and values. Our team members have breadth and variety of experience which collectively enhance the proficiency and capabilities we have to offer.

Five promises to Investors

- Excellence

- Integrity

- Creativity

- Respect

- Responsiveness

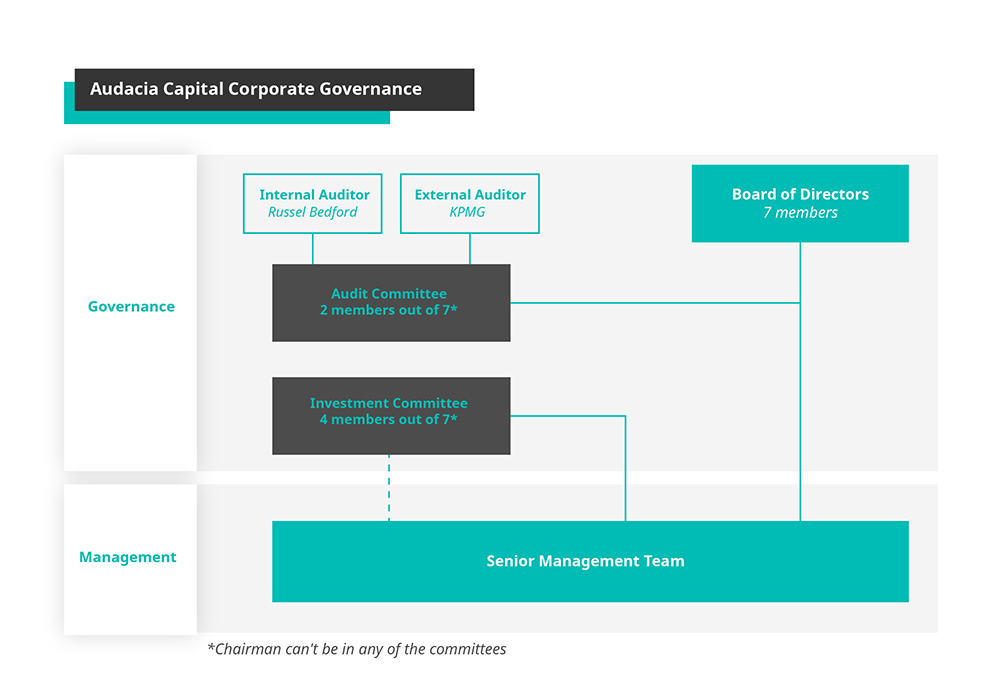

Governance

In a market where demand for sound corporate governance is growing at a rapid pace, Audacia Capital adheres to the highest standards of compliance built on international and principle-based governance structure in line with regulatory requirements.

Beyond our full compliance in accordance to the Dubai Financial Services Authority (DFSA), we have developed a holistic and strict internal framework of checks and balances. This framework guarantees that our actions and decisions are properly vested and adhere to the highest ethical standards. This ensure clear accountability and trustworthiness providing credibility and transparency to our stakeholders and investors.

Governance Framework

Board of Directors

Audacia Capital is governed by a seasoned seven-member Board of Directors; five executive directors and two independent non-executives. The Board provides strategic direction, management supervision and continuous oversight to endorse the success and long-term value of the company.

As part of our corporate governance, our Board Members are required to sign a Board Charter; a comprehensive and binding set of rules; defining how each Board Member must conduct oneself in relation to his role. An extract of the charter is as follows.

- The Board of Directors assumes supervisory role on all matters related to the day-to-day management of the company in addition to approving strategic plans, budget and certain recommendation to the AGM.

- All the Directors are nominated and elected by shareholders while the Directors elect the Chairman

- The Board meets a minimum of four times a year

- The Directors have no compensation

Board Diversity

Independence

- Independence is assured by avoidance of conflicts of interest between members, along with mitigation of correlated interests

- Independent board members have distinct backgrounds, with no prior business relationships or ventures in common

- No blood relations among members of the board

Experience

- Each board member brings a unique critical expertise for the management and governance of Audacia

- Our entire board members have extensive experience in their respective fields

- Our board extensive and diverse experience provides the right mix of management skills to guide management

Board Sub-Committees

- Audit Committee and Investment Committee are enacted and have full independence from management

- Both committees supervise the management team and report directly to the board of directors

Outsourced Compliance and Internal Auditing

- Compliance and internal auditing are outsourced to independent parties to ensure full independence and transparency

- Though not legally required, outsourcing internal auditing ensures the highest levels of credibility and accurate information administration to shareholders

- In addition, independent compliance and audit ensure no conflict of interest among stakeholders

Reliable Financial Reporting

- Detailed financial statements and reports are shared with all shareholders on a bi-annual basis

- Detailed financial statements and reports shared with all investors on a quarterly basis

Jaber Alsulaiti

Chairman

Jaber was Qatar’s Ambassador to the United Kingdom for six years, until he retired from public service and established Alahed, a contracting company that became one of the largest contractors in Qatar…

Efficitur lobortis amet faucibus feugiat aptent convallis cubilia bibendum nostra nulla arcu

Efficitur lobortis amet faucibus feugiat aptent convallis cubilia bibendum nostra nulla arcu

Efficitur lobortis amet faucibus feugiat aptent convallis cubilia bibendum nostra nulla arcu