Direct Investment

Core Qualities

Our in-depth knowledge of the sectors we invest in allows us to recognise market trends, source top-tier equity opportunities, evaluate and improve our portfolio.

We provide more than just capital to the companies we invest in, providing guidance to management that will ensure consistent growth and unlock unrealised potential.

We focus on building true, lasting partnerships with our assets’ management teams, empowering them and together creating transformational companies of enduring value.

We devise structured exit strategies that maximise shareholder returns, including trade sales or public market offerings, within a typical horizon of 3-5 years.

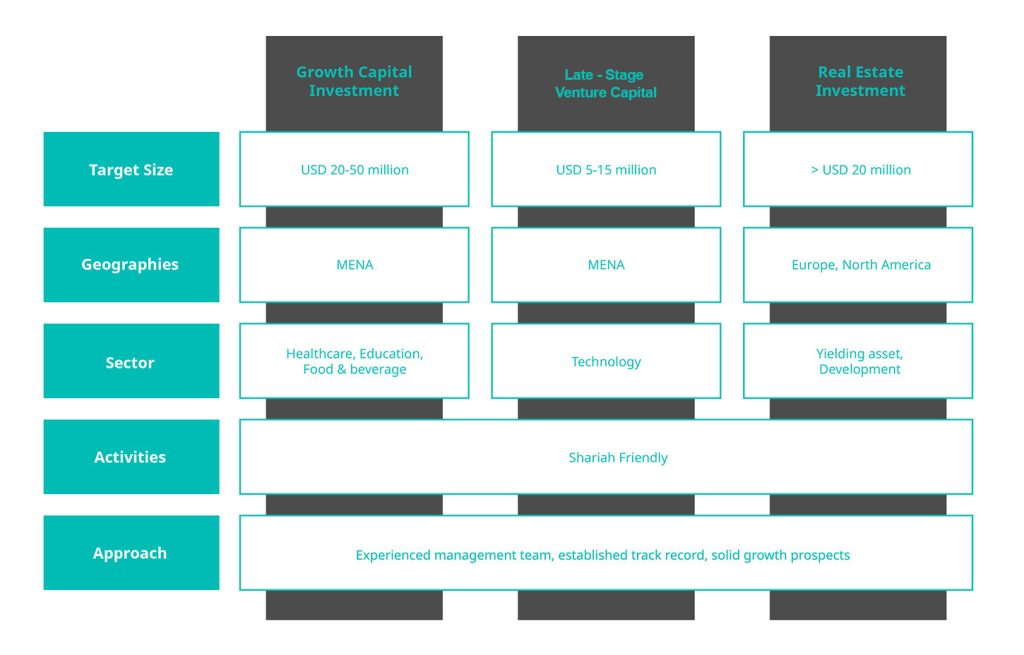

Growth Capital

Our investment team’s unwavering focus is locked on identifying and executing transactions that ensure long-term growth and superior returns across the private equity lifecycle.

What do we do?

Acquisition of significant stakes with board representation in established businesses, whose next stage of growth requires equity funding

Who do we work with?

We usually target companies with an equity value of USD 30-50 million, a high dividend yield, a strong track record and solid growth prospects. We specialise in the following sectors:

The Audacia edge

- Source unique transactions

- Focus on post-acquisition to ensure maximum value add

Late - Stage Venture Capital

We invest in the early stages of innovative companies run by talented entrepreneurs in the MENA region with unique value propositions

What do we do?

Accelerating emerging businesses’ development by providing financial support and managerial expertise, supporting performance enhancements and fostering entrepreneurship.

Who do we work with?

- We partner with passionate entrepreneurs with ideas that are innovative in their fields that will allow them to build a remarkable business.

- Team with track record and proven capabilities

- Proven business model

The Audacia edge

- Seed capital and series A funding thus taking the risk

- Provide valuable expertise backed by deep experience in strategy, finance and operations

- Series Raising

Real Estate Investment

What do we do?

Investment in strategically-located assets, with high occupancy rates, suitable tenants and long-term leases.

Real estate conversion through partnerships with leading developers, ultimately aiming for capital appreciation and an increase in yield.

On related transactions and opportunities, helping investors identify and execute real estate deals optimised according to their specific investment needs.

Who do we work with?

The Audacia edge

Investment Banking

What do we do?

Building on our regional market knowledge and experience, we provide expert advisory services to corporate clients pursuing complex transactional opportunities.

Bespoke and creative solutions for all types of trade sales, mergers and acquisitive activities.

Best-in-class advisory services on equity and equity-derived products (e.g. shares, options, futures), as well as a broad range of capital raising deals, from initial public offerings (IPOs) to other types of equity issuance.

Advisory services and sourcing of new borrowing opportunities; strategic debt origination and structuring.

Who do we work with?

We usually work with mid-cap companies across our specialty sectors in the MENA region, initially seeking businesses and institutions with whom we have existing relationships.

The Audacia edge

In order to offer best-in-class and comprehensive strategic advice, capital raising and risk management expertise, we leverage what we consider our greatest assets:

- Two-decades, extensive and industry-specific intelligence of the business networks and dynamics of the MENA region, as shown by our high-profile track record.

- In-depth knowledge of the regulations and compliance considerations that govern such business activities across markets.

- Forward-looking, innovative and holistic approach to building long-term relationships with our clients.